- Home

- >

- News

- >

- die casting manufacturing

- >

- Tesla’s war and bonfire lit in China

Tesla’s war and bonfire lit in China

Tesla (NASDAQ: TSLA) China's localization may be the most important thing in the field of China's new energy vehicles in 2019, except for the “subsidy retreat”.

Is Tesla, who is building a factory in China, a shark that swallows up the domestic new energy auto industry, or is it a squid that inspires Chinese auto companies to upgrade their vitality and bring new opportunities? What are the potential investment income opportunities for investors to set up in Shanghai?

01 Tesla China's factory background

At the beginning of January 2019, "Iron Man" Elon Musk came to China again. The head of the global electric car giant Tesla was also on the "News Network" because of the reception of the Prime Minister.

The main purpose of Musk’s visit to China was to participate in the groundbreaking ceremony of his Shanghai factory.

In October last year, Tesla announced that it had won nearly 1,300 acres of land in Shanghai's Lingang area for 970 million yuan to build a Gigafactory 3 plant that integrates R&D, manufacturing and sales functions. Tesla is "localized." The plant plans to produce 500,000 pure electric vehicles per year, and will produce models such as Model 3 and Model Y after production.

Tesla Shanghai Super Factory Grounding Ceremony (Getty Images)

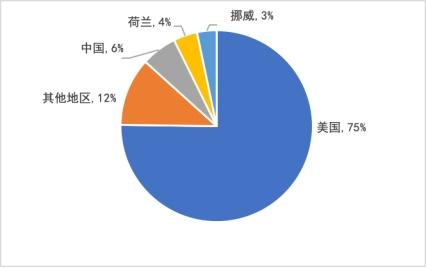

At the same time as the construction of the Shanghai plant, the Tesla European plant is also in preparation. In terms of revenue, China and Europe currently do not account for a high proportion: Tesla's 2018Q3 total revenue is 6.824 billion US dollars, of which the US has a 75% share, and China and Europe account for only 6% and 7% respectively.

Tesla's new overseas super factory will expand its production capacity, and it is hoped that it will further explore the new energy automobile market in China and Europe.

Figure 1: Proportion of 2018Q3 Tesla revenue by region

[1] Domestic new energy subsidies fall back

Due to the increasing energy shortage, environmental pollution and energy security challenges, countries are seeking to replace a large number of internal combustion engines that consume fossil energy with other energy power systems. The new energy car tide, Hao Haohao soup, swept the world. China has included it in the seven strategic emerging industries, and the degree of emphasis is self-evident.

Due to the short-lived mileage and difficult charging in the early stage of electric vehicle development, the market acceptance is low. China has adopted a number of positive policies to encourage the development of the new energy automobile industry.

It mainly includes: the central and local finances simultaneously subsidize the production cost difference of new energy vehicles, reduce and exempt the purchase tax, subsidize the operation of new energy buses, set up special license plates for new energy vehicles, and give priority to road access rights.

A series of subsidy policies have gradually cultivated China's electric vehicle consumer market.

After experiencing the prosperity of policy support, China's new energy auto industry has to face the impact of the policy subsidy.

In 2018, China raised the technical requirements and subsidy threshold for electric vehicles: the threshold value of the driving range of pure electric passenger vehicles increased from 100 km to 150 km, and the minimum energy density of the power battery system increased from 90 Wh/kg to 105 Wh/kg. The subsidy for pure electric passenger vehicles with a driving range of less than 300 kilometers is reduced by 1~21,000 yuan.

Although the new energy subsidy policy rules for 2019 are still unclear, the subsidy will continue to increase by 20% in 2017-2018. It will be a foregone conclusion, or 40%. By 2020, new energy subsidies for passenger cars will be achieved. The policy will be terminated.

[2] Globalization of new energy vehicles

After the subsidy policy is gradually withdrawn, the new energy automobile industry will also enter a new stage of global competition.

Since 2018, global electrification has become the trend of the times. According to the International Energy Agency report, global electric vehicle sales reached 1.1 million units in 2017, with more than 3 million inventories, 40% of which were put into use.

Take China as an example. From January to November 2018, the sales volume of automobiles was 25.42 million, down 1.7% year-on-year. Compared with the overall market downturn, sales of new energy vehicles have reached record highs: from January to November, the cumulative sales of domestic new energy vehicles was 1.03 million units, a year-on-year increase of 68%, which became the core driving force for the development of the automotive industry.

The world's mainstream car companies have also focused on new energy vehicles. Many global auto giants, represented by GM, Volkswagen and Daimler, have invested heavily in accelerating their electric vehicle strategy.

Domestically, China's own brands BYD (SZ: 002594) and Geely (HK: 00175) have also formulated new energy vehicle strategies. It plans to introduce more new energy vehicles in 2020 and achieve corresponding mass production targets.

Figure 2: New energy strategies for some car companies at home and abroad

Investing $19 billion; launching at least 10 new energy vehicles in China in 2020, with an estimated annual sales of 150,000 units; and annual sales of 500,000 units in 2025

Invested $84 billion to implement the Roadmap E electrification strategy; achieve an annual output of 3 million units and launch 80 all-electric vehicles by 2025, including 50 pure electric models and 30 plug-in hybrid models

By 2020, new energy vehicles will account for 90% of BYD's automotive business, and by 2030, it will fully realize the electrification of BYD's private car products.

In 2020, the sales volume of new energy vehicles accounted for more than 90% of Geely's overall sales. Among them, the sales volume of plug-in hybrid and hybrid electric vehicles accounted for 65%, and the sales of pure electric vehicles accounted for 35%.

500,000 sales targets in 2020, of which 200,000-300,000 are from its own platform, and 40% are sold in the international market; Beiqi New Energy's revenue is expected to reach 60 billion yuan

As the world's most important new energy vehicle market, the proportion of new energy vehicles in China increased from 42.2% in 2015 to 47.5% in 2017. With the withdrawal of the subsidy policy and the liberalization of foreign-funded ratios in the auto industry, China has undoubtedly become the strategic goal of major auto companies.

In addition, some people also joked that the new energy vehicle globalization is because the domestic new energy industry chain valuation has been unable to support, and must be supported by a larger story.

In any case, China will become the main battlefield for the global competition of new energy vehicles.

02 Tesla Giants' Strike Tour

It is necessary for us to sort out Tesla's family history and see how it has become the benchmark for the global electric vehicle industry step by step.

[1] The rise of Tesla

In 2003, Martin Eberhard and Mark Tapenen founded Tesla, the first car company in Silicon Valley, to develop high-performance electric sports cars. In February 2004, Elon Musk led Tesla's $7.5 million Series A financing, becoming the largest equity and chairman of the board.

In 2006 Tesla released the first roadster, the electric sports car. As the first mass-produced all-electric sports car to use lithium-ion batteries, and the first pure electric vehicle with a cruising range of 200 miles, from 2008 to 2012, Roadster sold 2,250 units.

Although the birth of the Roadster caused great concern, Tesla was plagued by mass production problems, and even was on the verge of bankruptcy.

In October 2008, with Elon Musk as CEO, Tesla officially welcomed the Musk era.

In the same year, Tesla released its second electric vehicle Model S with a range of up to 500 kilometers, which can basically meet the needs of most modern urban people. The acceleration time of 100 kilometers is about 3-5 seconds, even Compared with traditional luxury fuel vehicles such as BMW and Mercedes, Tesla also has a competitive advantage.

The Model S entry price is $57,000, positioning the mid-market, which is the representative work of Tesla's strategy of “creating a more profitable model and gradually achieving profitability”.

After the initial victory of the Model S, Tesla reached a strategic partnership with the Daimler Group, the parent company of Mercedes-Benz, and received a US$465 million loan from the US Department of Energy.

On June 29, 2010, Tesla raised $26 million through an initial public offering, becoming the first American auto company to be listed since the Ford listing in 1956.

In 2012, Tesla launched the Model X, the first all-wheel-drive SUV model, with its high-tech configuration and Eagle wing design for the luxury models such as the Porsche Cayenne, Land Rover Range Rover and BMW X6.

The real promotion of the electric car civilians, making Tesla into the ordinary people's home is the Model 3 released in July 2014.

Continuing the technological sense of ModelX, the Model 3 is equipped with a large central control panel, Autopilot driverless, front camera, radar, 360-degree ultrasonic sensor, OTA upgrade and other functions. However, unlike the former, the overall size of the Model 3 has been reduced, and the price is lower, which has caused strong market reaction.

Since accepting the reservation on March 31, 2016, Musk said in the tweet that as of April 3 of the same year, Model 3 has received 276,000 orders with a total value of more than $10 billion.

With super performance and futuristic design, in just over a decade, Tesla has won a number of loyal customers and has grown into a global leader in the electric vehicle industry.

In 2018, Tesla delivered a total of 245,240 vehicles, including 145,846 Model 3s, and 99,394 Model S and Model X. Nearly 250,000 electric vehicles sold far more than other electric vehicle companies worldwide.

Thanks to the success of Model 3, Tesla achieved revenue of $6.824 billion in the third quarter of 2018, and net profit turned positive to $255 million, which is Tesla's third profit in 15 years.

[2] Tesla's dilemma and break

However, the good performance in the third and fourth quarters of 2018 does not mean that Tesla has passed the "dangerous period" safely. This global electric car giant is still in a difficult situation.

On the one hand, the problem of insufficient capacity is still a haze over the top of Tesla.

In 2017, Tesla set a production target of 2,500 units for the Model 3 at the end of March 2018 and 5,000 units at the end of June. But the automated production line at its super battery factory in Nevada has problems, and software defects have prevented the robot from functioning properly. In March, Model 3 produced only 975 units per week.

Insufficient capacity combined with years of losses and huge research and development costs led to rapid cash flow consumption. Moody's downgraded Tesla's credit rating twice.

Although Musk implemented the “7×24” hour high-intensity operation at the original Tesla plant, replacing the machine with manual assembly, and setting up a temporary production line tent to achieve the target of 5,000 vehicles per week, but Tesla still did not. Can fundamentally break through the capacity bottleneck.

The Fremont plant in California originally provided services for General Motors and Toyota. After being acquired by Tesla in 2010, it was responsible for vehicle production. Although the Model 3 capacity of the plant has reached 7,000 vehicles per week, it is considered to be a low-priced version of US$35,000. With the launch of the model and sales growth in China and Europe, Tesla's delivery pressure is still huge.

On the other hand, the reduction in tax incentives is even more urgent for Tesla than the long-standing capacity problems.

According to the tax reform plan adopted by the US Congress in 2017, the total number of electric vehicles that a single car manufacturer can enjoy tax benefits is 200,000 units. After the sales limit is reached, the tax credit policy will be gradually phased out.

Since Tesla's electric vehicle sales exceeded 200,000 in 2018, according to federal regulations, Tesla's electric vehicle tax cuts will fall from $7,500 in 2018 to $3,750 in 2019.

In order to offset the impact of the reduction in new energy subsidies, Tesla decided to adopt a strategy of price cuts: Model3, Model S and Model X were uniformly reduced by US$2,000 in the US. In order to push the product to cut prices as early as possible, Tesla also announced a 7% layoff.

However, these measures have not been recognized by the market: although price cuts may boost Tesla's sales in the short term, it will affect its profit margin in the long run, which is the reason for its stock price crash. If you continue to deliver the car at the current rate, then the price cut means that Tesla will lose $700 million in 2019.

In addition, Tesla's consistently heavy asset model and continued capital expenditures have been questioned. The speed of burning more than $6,500 per minute has caused Tesla's free cash flow to be negative for several consecutive quarters. Coupled with high debt, Tesla's breakout is imminent.

In the case of limited domestic development, Tesla will look to China, the world's largest electric vehicle market, with a view to finding a way to break.

On May 10, 2018, after China promulgated the foreign-invested share ratio of the auto industry, Tesla registered the company in Shanghai with a registered capital of 100 million yuan.

From July 2018, news of the investment agreement for pure electric vehicle project signed with Shanghai Lingang Administrative Committee and Lingang Group was announced. Tesla finally decided to build a super factory in Shanghai Lingang area.

The plant is expected to complete initial construction in the summer of 2019, produce Model 3 at the end of the year, and achieve mass production next year.

In order to promote the construction of the Shanghai Super Factory, Tesla also established Tesla Financial Leasing (China) Co., Ltd. in the Shanghai Pilot Free Trade Zone to promote financing.

In addition, according to Musk, the construction cost of Tesla's Shanghai super factory is estimated to be 2 billion US dollars. The funds for the construction will come from domestic financing, including bank loans and “local debt”, without having to rely on selling stocks to raise funds.

For Tesla, as its second largest global sales market in China, the market has great potential and consumers have strong purchasing power. Building factories in China can shorten the cycle and cost from manufacturing to sales, increase production capacity and increase production efficiency.

In addition, the establishment of a plant in China can help Tesla achieve localized production and avoid the chain effect of the change in tariffs on imported cars, thus gaining a price advantage.

03 Tesla's war and bonfire in China

Since the implementation of the new energy vehicle strategy in 2009, China's new energy vehicle industry has developed rapidly with the promotion of preferential policies and strong subsidies.

In addition to BYD, BAIC and other traditional car companies actively launch a variety of new energy vehicles, Wei Lai, Wei Ma, Xiaopeng and other new Internet-powered vehicles rely on Tencent, Gaochun Capital, Sequoia and other capital giants, also strong - For example, in the 2018, the standard Tesla's Weilai delivered about 10,000 ES8s.

Considering the subsidy and the opening of foreign capital, it is a foregone conclusion that domestic automakers have entered a fierce global competition. With Tesla coming to China to build a factory, the first war has already begun.

First of all, the price band of the domestically produced Tesla will penetrate into the price band of domestic new energy vehicles, and the positive confrontation between the two is inevitable.

At the end of last year, Tesla announced that the starting price of the Model 3 long-life battery dual-motor all-wheel drive version in China was reduced from 540,000 yuan to 499,000 yuan. With the construction of the Shanghai super factory, the localized Model 3 is in tariff and manpower. Costs and procurement costs have gained an advantage, and prices will fall further, entering the 270,000 to 490,000 range.

This overlaps with the pricing of Weilai ES8 and SAIC Roewe Marvel X, or it will change the domestic mid-to-high-end new energy vehicle market.

Although the price is quite the same, the mileage of the domestic self-owned brand new energy vehicles is still far from the Tesla, and the price/performance disadvantage is obvious.

Model 3 top-end models have a cruising range of 499 kilometers, while the self-owned brand new energy vehicles are basically under 400 kilometers: Weilai ES8 has a cruising range of 355 kilometers, BYD E6 has a cruising range of 400 kilometers, and Roewe ERX5 has only 320 kilometers. .

In addition, the production capacity of Tesla's factory in China will further intensify the market competition of domestic pure electric vehicles. According to analysis, China's pure electric vehicles will reach 1 million vehicles in two years, and the production capacity of Tesla's 500,000 vehicles will put pressure on the entire market.

But as the saying goes, he was born in sorrow and died in peace. As the benchmark for electric vehicles in the world, the squid effect brought by Tesla's construction in Shanghai will also force the domestic new energy auto industry to further optimize and upgrade, and stimulate the innovation and research and development of local auto companies.

In addition, the localized Tesla will also provide great opportunities for local suppliers to ignite the Chinese new energy auto parts industry in the upstream of the industrial chain.